Redevelopment Hell: How a prime opportunity for redevelopment in South Los Angeles became the bane of the community

By Emily Henry of Intersections South LA and Eddie North-Hager of LeimertParkBeat.com

Santa Barbara Plaza has been whitewashed, boarded up, security gates padlocked. Most of the 240 small and large shops once here have been relocated, were bought out or have gone out of business.

Yet this Los Angeles shopping center -- the size of 20 football fields,

larger than the footprint of the Century City mall -- just sits there

waiting for a bulldozer. (Read the accompanying story: One of these do not belong.)

The vacant lots and decaying storefronts have long been sore points for the residents who live near the corner of Crenshaw and Martin Luther King Jr. boulevards.

Attempts to rejuvenate the complex known by many as Marlton Square have been a complicated failure spanning more than two decades. The reasons are plenty: litigation, backstabbing, unstable developers and perhaps even the naiveté of the Los Angeles City Council.

A ray of hope seemed to have broken the clouds once again in 2010. After years of silence on the project, the L.A. Community Redevelopment Agency issued a request for qualifications (RFQ), a step in the process of finding a developer.

But hopeful applicants may be in for a disappointment; the job they are applying for does not yet exist.

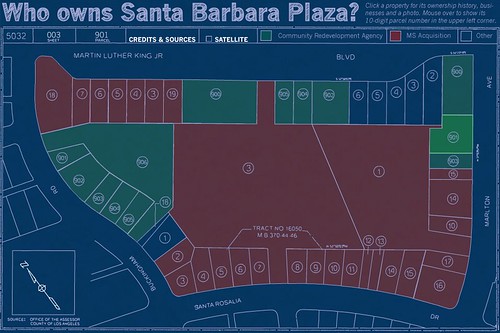

Currently, the CRA owns one-third of Marlton Square. The rest has been victim to a struggle over ownership rights since the city’s chosen developer abandoned his post, leaving a trail of paperwork

and angry constituents. Litigation has been continuous since April 2006, when the bank responsible for lending the cash to buy up the rest of the Marlton Square parcels - USA Capital - went bankrupt. Two years later, the developer followed suit.

According to 8th District Councilman Bernard Parks, it could be years before the city sees any movement in the direction of progress at Marlton Square.

“The bankruptcy dictates everything,” said Parks. “If all goes well, it would be a miracle if you had a product in five years.”

Five years.

There is no way to know who will come out of the USA Capital court proceedings as the owner of the remaining properties that cover an area equivalent of nearly 11 football fields. Until the CRA can begin

negotiating with the new ownership, little can be done. Beginning the search for qualified developers is a way of scouting talent in the mean time, but the job comes with no set start date.

“The purpose of the RFQ is to determine the types of firms that would have the capacity to potentially complete a retail/commercial development at a later date when the other parcels are out of litigation,” said Carolyn Hull, the South L.A. regional administrator for the Community Redevelopment Agency. “The timetable for development of Marlton Square is dependent upon the litigation schedule on the otherparcels. At the moment CRA/LA is not a party to that litigation and does not have any credible information as to when those cases will be adjudicated.”

All Tied Up

With the Baldwin Hills Crenshaw Plaza mall across the street, Marlton Square seems a prime location for redevelopment. The mall owners have just begun a $30 million upgrade at the same intersection where the blighted Crenshaw Discount Swap Meet in Santa Barbara Plaza has sat vacant for years. Decades of neglect have rendered the area an embarrassment in contrast to the community around it, hip Baldwin Hills, artsy Leimert Park and swanky View Park.

“The area has changed a lot,” said Rashod Conkrite, who walks through the rubble of Santa Barbara Plaza on his way home from work. “If you know anything about the area back in the ’80s and early ’90s, it was drug infested. Now they cleaned it up a whole lot. You are seeing more

diversity. I think it could prosper.”

But the complex conundrum of Marlton Square is a difficult one to solve,even for a company like Capri Capital Partners, owners of the Crenshaw mall.

“I’ve watched Marlton Square personally for a number of years,” said Ken Lombard, a partner at Capri. “We have a tremendous amount of interest and would love to be involved at the point that the project is ready to go.”

Lombard probably knows the project as well as anybody. He worked with Magic Johnson in the late 1990s when they were on the cusp of getting the needed government subsidies to take on the Marlton project. Today the fractured development area is a red flag even for Lombard, whose

company bought the Crenshaw Plaza mall for $136 million in 2006.

“I would have concerns about getting involved in any development that would not include the entire parcel,” said Lombard, whose company did not submit an application to the CRA during the request for qualifications. “Our plan was to wait and see. My hope is that with time things will be worked out.”

A History of Disappointment

The past is strewn with moments of hope for Marlton Square, quickly followed by disappointment.

Star power brought the project into the spotlight throughout the late 1990s and early 2000s. Basketball-star-turned-developer Magic Johnson won the exclusive right to negotiate in 1996, only to lose the deal to football star Keyshawn Johnson.

“Our time had run out,” said Lombard, who partnered with the Magic Johnson Development Corp. before taking over the Baldwin Hills-Crenshaw Plaza.

Lombard said the lack of cooperation from the 40-plus owners of Santa Barbara Plaza dissuaded his team from taking on the project. Unable to obtain control of the parcels, the Johnson-Lombard team suffered a major setback when Walmart pulled out.

“We decided to move on,” said Lombard. “Marlton Square is a critical component to the overall successful development of the Crenshaw corridor. This is a tremendous community that deserves the best options.”

Meanwhile, the CRA moved on as well.

Enter a New Hope

Capital Vision Equities, owned by Chris Hammond, had important allies on the Los Angeles City Council, including Mark Ridley-Thomas. The two had met in 1988 when Hammond was campaign manager for Jesse Jackson’s presidential bid. Ridley-Thomas introduced Hammond to USC and NFL football star Keyshawn Johnson, who invested around $500,000 in Hammond’s successful Chesterfield Square project. The $53 million project featured a Home Depot, grocery store and more just a few miles from Santa Barbara Plaza. The two teamed up once again to tackle Marlton Square, and with the endorsement of Ridley-Thomas, the deal was made in January 2001.

From the beginning there were signs that Hammond was a risk and questions remain as to why Hammond was chosen for the project valued at $169 million. Months before the city chose

Hammond as the developer, he had contributed $2,000 to soon-to-be Mayor James Hahn, with another $2,000 in 2001. Hammond also contributed $1,500 to Mark Ridley-Thomas between 1998 and 1999, and $5,000 to Rocky Delgadillo for city attorney. Hammond’s wife, Ayahlushim Hammond, who worked for the CRA at the time of his introduction to the project, contributed $3,000 for Hahn’s mayoral campaign between 1998 and 2001 and $1,500 to Ridley-Thomas.

Amazingly some of the campaign contribution checks bounced even prior to the Marlton Square deal. Investigations in 2004 found that Hammond had bounced more than $200,000 worth of checks

across the city, including campaign contributions. His loans went into default, and despite spending millions of dollars, Hammond failed to secure enough property to see the project through.

City Controller Laura Chick criticized the CRA for failing to run thorough background checks on Hammond, his partners, and Capital Vision Equities. By then Hammond was already deep into borrowing money, buying up properties and even building.

When Ridley-Thomas chose Hammond, the councilman was on his way to Sacramento, winning a seat on the state assembly, then the state senate; today he’s a county supervisor. All the while he has represented the area that includes Santa Barbara Plaza. Though he did not respond to requests for an interview about the state of Santa Barbara Plaza, it was once his priority: “As for my own efforts, I will not rest until there is economic vitality once again at Sant....”

Sign of Progress?

The one sign of progress that exists today - four-story Buckingham Place senior center - was an utter failure from inception.

There were supposed to be three buildings with 180 beds. Only one stands, has 70 beds, and is uninhabitable. The U.S. Department of Housing and Urban Development last year found the city failed to have a competitive bidding process or scrutinize Hammond’s financial equity.

The audit accused L.A. officials of failing to responsibly oversee the development of Buckingham Place. It only took a month for the city to respond and agree to ensure compliance to federal rules and improve administration.

The federal government had given $8.5 million to the city - which “lacked written procedures and had insufficient monitoring controls in place for projects.” The city, in turn, gave the money to Hammond. And if the city doesn’t finish Buckingham Place by 2012 the feds want the money back.

As the pink and green senior complex rose, Hammond borrowed millions from private lenders. By 2006, Hammond’s had secured about 25 properties- about half of Santa Barbara Plaza.

But Hammond was stringing everyone along those five years, creating an intricate financial knot that the city cannot untie.

Breaking the Bank

The knot became Gordian when Hammond’s bank went bankrupt itself in 2006. Hammond had taken a $36 million loan from the Las Vegas-based USA Capital to buy the parcels, all the while soliciting cash from multiple investors. When USA Capital dissolved, it made history as the largest company in the state of Nevada to go into bankruptcy, leaving a mess comprising $962 million in assets and more than 6,000 investors. Convicted of fraud, former owner Joseph Milanowski was sentenced to 12 years in prison in April this year and ordered to pay $86.9 million in restitution.

The deeds to the parcels are trapped under the name of MS Acquisition Company LLC, a venture created by Hammond and his retail business partner Jeff Lee, owner of the Lee Group Inc and Lee Homes in Marina Del Rey. Documents show that there are 300 investors tied to the MS Acquisition loan. The battle over which creditors control which assets continues. Marlton Square is not the priority.

According to Parks, the city only lost around $7 million by investing in Hammond, only because of safeguards within the contract, created with a sense of mistrust, the councilman Parks said.

“In my judgment there was little confidence in him the way (the city) wound the deal so tight. They were adamant you cannot get a dime of city money until you accomplish this."

The city would invest $7 million until Hammond could secure 80 percent of the Marlton Square property. A further $40 million was at the ready, but Hammond never got his hands on it as he defaulted on the project in 2004.

Though the city hedged its bet and “only” lost $7 million, the decision to go with Hammond cost the neighborhood 10 extra years of living amid the crumbling ruins that attract crime and repel opportunity.

Councilman Parks said that although the lack of progress can be disheartening, his mode of operation has been to think “long term” by buying as much land as the CRA can afford, and stockpiling for a time when the nearly bankrupt city has more money to invest in redevelopment.

“The project, if you had to do it over again, you would do like we are doing now,” Parks said. “All the property along King Boulevard, the city has found money to purchase it. They own everything but two properties along King. With ownership, you have site control.”

For residents hoping to see change, a ghost town covered in graffiti will remain the status quo. Living within sight of the eyesore incites anger and disappointment, and after decades, indifference in many.

“Now it’s just a big sewer,” said Deborah Johnson, who lives nearby and uses Santa Barbara Plaza as a shortcut on her bike. “People come in pretend they are going to start something and they stop. It just brings down the whole neighborhood, you know. Don’t nobody want to come over to an area where you turn down the street and you see all this. It looks like a war zone. I don’t think in any other neighborhood, this mess would be like this for this long.”

Chris Hammond could not be reached for comment. He represented himself in bankruptcy court and a lawyer representing Chris Hammond could not be found. Jeff Lee, Hammond’s partner in the residential part of Marlton Square, did not respond to requests for interviews.

On the business index for Hammond's Capital Vision Equities, LLC, Minnie Talton is listed with the California Secretary of State's office as agent for service process. The company’s status is suspended. Talton said she left the company in 2006 and was surprised to find she was listed as the person who would get a subpoena for the company in the event of lawsuit. She wouldn't talk about the company. As to Chris Hammond's whereabouts, she repeated what others have said.

"I haven't talked to him in years; I don't know how long," Talton said. "I don't know where he is. Sorry."

--

This crowdfunded, crowdsourced piece of investigative journalism was funded through Spot.Us.

Comment

-

Comment by Marlon Dorsey on September 8, 2010 at 9:58pm

-

Kudos to your wonderful reporting on this ongoing fiasco. I have witnessed the deterioration of this development from its glory days of the 60s and 70s firsthand. As a child I fondly remember many of the shops, services, bank and stores of Santa Barbara Plaza. Unfortunately today, I live up the street from this "mess" and have to look at it every waking day. For all of your good work though, we may never fully understand what "really" happened behind the scenes with the political and private deals that no doubt were made. Laura Chick was on point when she raised the issue of certain improprieties and hand wrangling that were taking place between Hammond, associates and certain political members. If it had not been for certain "foot dragging" on part of the city, Johnson Development and Victor McFarlane would have completed this project several years ago and we would have had a quality product. This is evidenced repeatedly by the success that the Canyon-Johnson Urban Fund collaboration has had in redeveloping blighted areas in many cities across the nation. I would love to see Capri Capital Partners and Ken Lombard be able to take over this project and development the RIGHT way. As a former president of Crenshaw Neighbors Inc., I have been involved in numberous community and neighborhood meetings over the years and it is my hope that this web/blog/site will grow and expand to address all of the issues of this community as a catalyst for a new "grassroots" community movement. Self preservation drives the need for positive and sustained action.

In closing I would like to share with you an email that I had sent to a journalist in May of 2008 in response to a L.A. Times article that he wrote on this very subject:

"Hello Ted:

I read your accurately and well written article in Monday's 4/28/08 edition of the L.A. times with great interest. This has to be one of greatest urban redevelopment tragedies of all time, at least for Los Angeles. It amazes me that none of our political leaders(?) who were involved in the approval process and/or responsible for fiscal oversight will take any kind of responsibility for this travesty. Laura Chick had concerns from the very beginning but because of self interest and personal agendas the city council overwhelmingly chose to give Chris Hammond carte blanche and an open ended checkbook to, what is obvious now, enrich his own bank account and those of his close associates. So much of what has happened in this process defies common sense and judgment. Today, maybe it is more like "uncommon sense." No one seemed to have performed any kind of due diligence even in light of this guy bouncing checks to the very people who signed off on him, from the mayor at the time on down. I guess the value was not in the checks that he wrote but the checks that were written from others who Hammond encouraged to contribute to their campaigns. Amazing!

Interestingly enough, in 2004 I had a subscription to the Daily Commerce and was browsing through the Notice of Default section and guess who I happened to see was in default on his home in Malibu and Los Feliz. I shared my discovery with my wife and neighbor and they could not believe that Hammond was given the reigns to a $170,000,000 project but couldn't (or wouldn't) pay his own mortgages. Then we read articles in the L.A. Times about his bouncing of checks to Mayor Hahn and other local community politicos. Unbelievable! Then, Christmas of that year, I believe, there was the first annual lighting of the "Unity" tree on the site of the Santa Barbara Plaza and guess who shows up driving a $150,000+ mobile home. Talk about grandstanding. It seems that Mr. Hammond was only interested in putting out the perception that he really "had it goin' on."

Now I understand that he actually owns two parcels in the plaza, of which I assume he purchased with some of the money that was advanced to him, and is waiting for the highest bidder to come a calling. With development fees and the "cashing out" of the properties I'd say Mr. Hammond has done quite well for himself in spite of an unfinished, dilapidated and run down eyesore that has gone from bad to worse. I live directly up the street from the plaza and have to look at the graffiti smeared facades from my front yard on a daily basis. I've seen the chronological regression of the project from start to current state. I have friends who have businesses in the plaza who have not received any relocation assistance. I've seen the trucks and heavy equipment moving and digging up dirt with no positive and productive result. I've been to the CRA sanctioned CAC meetings from time to time, only to hear the same rhetorical answers. What gets me is that I can attend a meeting today and they will still be on the same page as they were in 2003-2004. It is a joke and a total waste of taxpayer dollars. No Progress.

Instead of harping on the past and what has or has not been done I would rather see more innovative and proactive strategies and ideas going forward. Mr. Hammond and his assorted shell businesses should be investigated to the fullest extent and at an extreme minimum should be held accountable for passing all of the bad checks. He needs to be held accountable for "bamboozling" the community. I can't say the same for the city because they should have known from past experience with the Alexander Haagen Company and the financial problems that had occurred with the development of the Baldwin Hills-Crenshaw Shopping Center. The city was taken for a ride then. Shame on them. No excuses. It seems today that our government, from the federal down to the local is alarmingly incompetent or incapable of fiscal management and oversight when it comes to the development and redevelopment of our cities' infrastructures. "We the people" takes on a different significance today. In my opinion, it is increasingly going to take more effort and involvement from local citizens to take charge of the "quality of life" in their communities. I was a past president of Crenshaw Neighbors, Inc. which originally was created in 1964 to address local concerns of "steering" and "blockbusting" in the Windsor Hills, View Park, Crenshaw Manor, Baldwin Hills, Baldwin Vista and Leimert Park neighborhoods. Throughout the years the charter and the mission changed due to demographic shifts and economic needs, but the "spirit" of the organization remains intact with only a few dedicated active members keeping it alive. With modern communications technology there are ways and methods to effect change in a far greater way than were available just 10 years ago. This is starkly evident in the current presidential campaign. With a government that is mismanaged, underfunded and overspent (on the wrong things), the power of the individual becomes more important to the sustainability of a decent quality of life. I feel that the next generation, our (baby boomers) kids, with their embracing of, and ease of use of technology and the resistance to the status quo, will get it right. Or at least point us in the right direction. Hopefully we will show them more ethical leadership and stewardship going forward so that it won't be such a burden when they take over the reigns.

In closing, I'd like to share one idea on how to start bridging that gap and getting everyone involved and concerned about our community. In the past (and currently), in order to garner support from the community on issues and concerns, one of the tools that we used was the power of the petition. This was a labor intensive task that required many foot soldiers and a lot of explaining (sometimes inaccurately) to galvanize people and get them involved in a local or community issue. Sometimes surveys were used, but again this was labor intensive and cost inefficient due to the low response rates. Today we have the internet, email, text messaging, video conferencing, YouTube, MySpace, Second Life, etc, etc, etc. What if the CRA or a local government agency could provide funds for creating and maintaining a "Rebuild Santa Barbara Plaza / Marlton Square" website for local citizens and all others concerned to obtain and share information, submit their comments, support (or lack thereof) and ideas about what this community needs and wants to see. Petitions could even be created for consensus building. This could prove to be more effective than just having the once a month CAC meetings with limited attendance to hash over the same issues within an allocated 15 minute time slot. No wonder nothing of significance has been accomplished. Traffic can be driven to the website by posting a few billboards in strategic locations, e.g. Crenshaw and Martin Luther King Jr. Blvd., LaBrea and Rodeo, Crenshaw and Slauson, etc. Local papers could have a public information slot in the community section and/or maybe a public announcement on the local radio stations. But here is were the "real" democratic power of the people comes in. Included on the web site could be the opportunity for the community to truly "buy in" in real dollars and cents. Just as what the Canyon-Johnson fund has done to achieve the billion dollar mark in its inner city community reinvestment portfolio, so too can the community do with the right management and oversight structure in place. Individuals could have the option of purchasing shares of ownership or receiving an attractive return on their investment. There could be a minimum investment of $100 or some other affordable amount that collectively could create a significant pot of private money funding. Our Economic Stimulus Rebates would have been perfect for this. It could have the added effect of regenerating a sense of community pride, involvement and ownership. I certainly would support retail and commercial that I had a vested interest in. It is a very simple idea that would entail a lot of complex moving parts, but it is this type of "out of the box" thinking that is needed to create momentum, solutions and buy-in in our communities from the ground up. Grassrooted efforts in my opinion are the future of sustainable and environmentally sound development in our neighborhoods and communities. It is being done in other cities and towns across the country. This is just one possibility amongst many others but someone needs to get the process (not dialogue) started. It's been 20 years too long, stalled on this redevelopment dialogue. The Chris Hammonds of the world will always be out there but if there are more stakeholders involved to perform more due diligence and hold the city and developers accountable for fiscal and monetary oversight, maybe future debacles such as this can be prevented.

Hopefully your article will be a wake up call to action.

cc: Community Stakeholders"

--

-

Comment by Susan on September 8, 2010 at 9:55pm

-

I guess I have just one more question after re-reading the article. How is it that CRA is not involved in the litigation if it was responsible in the first place for selecting Hammond despite obvious evidence that he was not financially solvent? Am I misreading or misunderstanding something here? Are they just walking away and letting it sit? Don't they have some obligation to pursue the case? I agree with Deborah Johnson.

-

Comment by Mark on September 8, 2010 at 5:32am

-

Good work Emily and Eddie. We sometimes wonder what happened to solid investigative journalism then something like this pops up. Thanks for being there setting a standard for "mainstream journalism" to try to follow.

-

Comment by enhager on September 7, 2010 at 7:49pm

-

That is exactly what I told Walter Melton when we were finishing up the story. How depressing. There was a time when we first started that we hoped we would find good news - it was closer than ever, people told us.

Then we found that most of the property was in the hands of just two entities - the city and MS Acquisitions. We were so excited - two owners down from 40. They just needed a developer. And the city put out a request for qualifications on the land they owned.

Then finally we got that interview with Councilman Parks. He sat down with Emily for an hour and 20 minutes to explain, from his point of view, what happened. It all checked out - a bankruptcy of a bank who had foreclosed on the properties. Now there was litigation.

And we were back where we started - a terrible, unending blight on our community.

-

Comment by Susan on September 7, 2010 at 7:30pm

-

Congratulations on a great, if somewhat depressing, report. I really enjoyed reading it and seeing the video clip. I'd love to hear more about the research.

- ‹ Previous

- 1

- 2

- Next ›

Leimert Park Beat is the news and social network for Leimert Park and the surrounding neighborhoods. Stay informed. Join now!

• Got news you think everyone should know? Blog it.

• Have a show or attending a benefit? Put it on the calendar.

• Video of the big game? Embed it.

• Photos of your business or the school play? Upload them.

WHAT STORIES WOULD YOU SUGGEST? Let me know.

With your help, LeimertParkBeat.com raised money to hire reporters, graphic artists and community members to cover our area.

Read the stories - Urban Economy 411, Redevelopment Hell and One of these don't belong.

Latest Activity

Stevie Macks Prison Tales one-man show is a hit!

Coffee Love Sunshine Summit | Dr. Angela Chester Presents on Living a More Balanced Life

29th Annual Central Avenue Jazz Festival at Central Avenue Jazz Festival

Virtual Event | Faith over Fear: Controlling Domestic Violence with Hope

© 2024 Created by enhager.

Powered by

![]()

You need to be a member of Leimert Park Beat to add comments!

Join Leimert Park Beat